Kansas Real Estate Property Tax Appeal Services

The professionals at Savage & Browning recommend that you retain representation throughout your Kansas county appraiser valuation appeal.

The annual savings associated with reductions in real property valuations can be quite large, into the tens if not hundreds of thousands of dollars, or more.

Knowledgeable and experienced attorneys, appraisers, accountants and other real property tax experts will greatly increase your chances of a reduction in valuation and help you navigate the complex appeal rights of the parties after a BOTA order.

Even though the burden of proof is on the county to substantiate its valuation, you must be prepared to demonstrate why your valuation is more accurate. For over 50 years Savage & Browning have been appraising, accounting and negotiating real property valuation throughout Kansas. That's why we remain the top property tax protest consultants in Kansas.

We represent Kansas property owners in their county tax appraisal appeal. We have won successful real estate property tax reductions for our clients in Johnson County, Sedgwick County, Shawnee County, Wyandotte County, Douglas County, Leavenworth County, Riley County, Butler County, Reno County, Saline County as well as in every corner of even the smallest Kansas county.

We often are able to find more compelling reasons for reduction and additional favorable comparable properties to support the appeal in the more urban areas of Wichita, Overland Park, Kansas City, Olathe, Topeka, Lawrence, Shanee, Lenexa, Manhattan and Salina.

Fair Market Value by County Appraisers

In Kansas appraisers in each county are responsible for valuing all property January 1 of each year. Properties are appraised in the most fair manner possible and are based primarily on fair market values.

*Exceptions:

Land devoted to agricultural use is valued based upon the income or productivity of the land. Commercial and industrial machinery and equipment is valued based upon a formula set forth in the Kansas Constitution.

What is fair market value and how is it determined?

By definition, fair market value is the amount an informed buyer is willing to pay and the amount an informed seller is willing to take for property in an open market with no undue influence.

Typically, fair market value is calculated using one of three methods:

- Sales Approach - the county appraiser reviews similar properties that have sold, compares them to your property and may make adjustments for differing characteristics. This approach is most suitable to simple residential property in an area with a good number of sales of comparable properties.

- Cost Approach - the county determines replacement cost of the property less depreciation. This approach is most suitable to a new or unique property with few comparable properties.

- Income Approach - the value of the property is estimated based upon the income the property is expected to produce. This approach is most suitable to value commercial property when sufficient market rent and expense information is available.

Each county must mail valuation notices to all property owners on or before March 1. Your county assessor maintains a property record card (“PRC”) that documents how your property was valued including comparable sales used in determining market value.

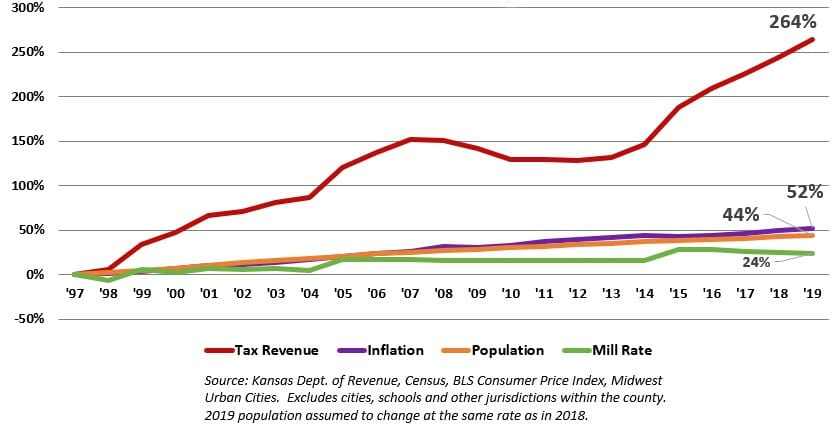

The trend by county appraisers is to increase valuations based on sales of new properties. Rising prices plus population increases can lead to unjustifiable tax increases. Consider Johnson County where property tax revenues have increased 264% since 1997.

Johnson County Property Tax Increase

2.7 Times Inflation + Population

Appealing County Valuation

If you feel that your property is assigned a value that does not reflect its fair market value, you are entitled to appeal the valuation by either filing, or having your representative file an appeal with the county appraiser. The deadline to file an appeal is within 30 days of the date the valuation notice was mailed.

Once you start this appeal, be sure to pursue it to your satisfaction. If you abandon or drop your appeal, you cannot appeal later for the same property and tax year.

Informal Meeting: The appeal process begins with an informal meeting with the County Appraiser's Office. At the informal meeting, the County Appraiser's Office must provide you and/or your representative with documentation supporting the value. You and/or your representative will also have the opportunity to explain why you believe the county's value is not correct.

Small Claims Division: If you and your representative are not satisfied with the results of the informal meeting, and the property a) is a single-family residence or b) has a value of below $3 million and is not agricultural land, you may appeal to the Board of Tax Appeals (BOTA) Small Claims and Expedited Hearings Division. If your property is a single-family residential property, you MUST appeal to the Small Claims Division before proceeding to the full Board of Tax Appeals. Appeal by filing the proper form (available from the county) with the Court of Tax Appeals within 30 days of the mailing of the informal hearing results.

Board of Tax Appeals (BOTA): You and/or your representative may appeal the valuation decision from the Small Claims Division, or if your property is not a single-family residence, you may appeal directly to BOTA. You must file the proper form with BOTA within 30 days of the mailing of the Small Claims Division decision or county's informal hearing decision.

NOTES:

-

- Some of the Appeal filings may require Filing Fees.

- You may be accompanied or represented by a designated representative at the informal hearing, BOTA Small Claims Division or BOTA full hearing.

- You may be represented by an attorney, a certified public accountant, a certified general appraiser, a tax representative or agent, a member of the taxpayer’s immediate family or an authorized employee.

- If the representative is not an attorney, the representative must provide a completed Declaration of Representative form.

- At a full BOTA hearing the representative will not be allowed to question witnesses unless they are an attorney.

- The county must initiate the production of evidence to substantiate the validity and correctness of the property’s valuation, except in the case of leased commercial and industrial property, when the burden of proof shifts to the taxpayer unless you have furnished a complete income and expense statement for the property for the 3 prior years.

- BOTA must accept into evidence a single property appraisal presented by a taxpayer with an effective date of January 1 of the year appealed which has been conducted by a certified general real property appraiser which determines the subject property's valuation to be less than that determined by a mass real estate appraisal conducted by the county.

- Generally, BOTA will issue a written summary decision within 14 days after conclusion of the hearing unless the parties agree to an extension.

“New” Appeals Option beginning with Tax Year 2017

Alternatively, if you do not appeal the notice of informal meeting result to BOTA, you are allowed to file a third-party fee simple appraisal performed by a Kansas certified general real property appraiser that reflects the value of the property as of January 1 of the same year being appealed with the county appraiser within 60 days from the mailing date of the notice of informal meeting result.

The county appraiser has 15 days after the timely receipt of the appraisal to review and consider the appraisal in the determination of the valuation or classification of the property and mail a supplemental notice of final determination. If you are not satisfied by the final determination, you may file an appeal to BOTA within 30 days.

Don’t delay. Contact Savage & Browning today and let us get a jump on valuing your real properties and determining the best cases to be made for assessment reduction.

With the uncertainty of Covid-19 shutting down many businesses, property owners have seen unprecedented shifts in cash flow from shuttered businesses or residential tenants who lost the ability to pay rent. Additionally, there are other considerations that can be presented to justify assessment reductions:

- Equitability of the Assessment

- Building Age and Type

- Needed Improvements and Repairs

- Vacancy

- All Forms of Depreciation / Obsolescence

- Highest & Best Use of Your Property

As a part of our long history, our team worked hard over the years to build and maintain positive relationships with the various assessment offices and other property tax professionals. These relationships facilitate appeal and negotiation since we have proven our credibility time and again.

Our Process

We start each engagement with a Real Estate Appraisal Review that includes:

- Obtaining data from you, the client and taxing authorities.

- We identify appraisal methods used in assessing properties and audit the results for accuracy.

- We aggressively seek and secure refunds for past years tax over-payments when inaccurate assessments are identified.

- We use cost, market and income approaches in preparing appeals for presentation to taxing authorities.

- We review the assessed value of comparable properties to ensure fair and equal standards.

- We use comparable assessments and calculations of cash equivalency values in presentations to taxing authorities.

If we determine that your real estate valuation by the county is unjustifiably too high, we go to bat for you throughout the entire Real Estate Property Tax Appeal Process:

- We arrange for and conduct diligent, informal settlement discussions with taxing authorities.

- When advisable, we file written protests with tax appraisal review boards for all unsuccessful appeals at the informal level.

- We attend hearings and offer personal presentations of expert testimony before tax appraisal review boards to support lower values.

- If appropriate, we recommend legal counsel and provide support services for continuing an appeal at the state level.

Throughout the entire process you will receive status reports and so you know where we stand in your property tax valuation reduction appeal:

- A preliminary tax savings report using estimated tax rates.

- A final tax savings report using actual tax rates and identifying savings by property.

- A tax comparison report on a property-by-property basis including current and prior year's values and taxes.

- A narrative report pertaining to research, analysis, and negotiation activity.

Once we have established a familiarity with your property we are prepared to Administer your real estate property tax valuation on an annual basis, always looking for opportunities to appeal and reduce valuations or mitigate increases in valuation.

On your behalf we will:

- Respond to inquiries from taxing authorities.

- Provide tax estimates for accrual and budgeting purposes.

- On a timely basis, obtain, audit and forward tax bills to clients with an approval letter.

- Seek and secure corrected tax bills where inaccuracies are discovered.

- Upon request, provide clients with copies of parcel maps from taxing authorities.

- Verify the property tax proration on escrow closing statements for acquisitions or dispositions.

Important Dates

| REAL ESTATE | ||

|---|---|---|

| Date | Events | Notes |

| Jan 01 | Assessment Date | |

| Feb – Mar | Value Notices Issued | |

| Mar 31 | Appeal Deadline | Equalization Appeal Option |

| May 10 | Tax Bills Due | 2nd half installment (Most Counties) |

| Nov | Tax Bills Issued | |

| Dec 20 | Appeal Deadline | Payment under Protest Option |

| Dec 20 | Tax Bills Due | 1st half installment |

| PERSONAL PROPERTY | ||

|---|---|---|

| Date | Events | Notes |

| Jan 01 | Assessment Date | |

| Mar 15 | PP Returns Due | Inventory exempt |

| May 01 | Value Notices Issued | |

| May 10 | Tax Bills Due | 2nd half installment (Most Counties) |

| May 15 | Appeal Deadline | Or 15 days after notices are mailed |

| Nov 01 | Tax Bills Issued | |

| Dec 20 | Tax Bills Due | 1st half installment |

Ready to reduce your Kansas real estate property taxes?

Contact us today to learn more about how we reduce the single highest expense for most income producing properties.